|

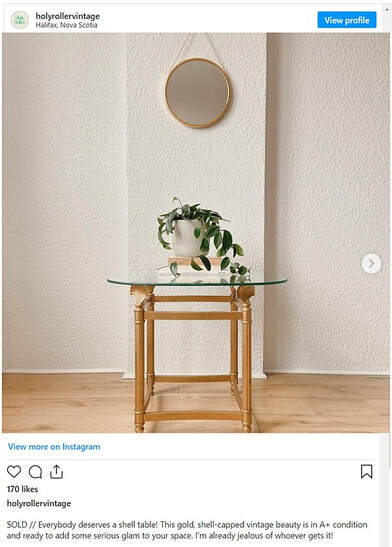

Inflation Is Rising But You Wouldn't Know It According To Most Auction Houses  Substantial Gains In Sales Of Art & Antiques Substantial Gains In Sales Of Art & Antiques New York - It's probably not that much of a surprise to many of the industry's heavy-hitters, but for those working in the day-to-day milieu of the more pedestrian aspect of the decorative arts world (the rest of us), the news of just how far and high some of last year's auction sales figures have risen, is likely to be nothing short of stunning - especially when one considers the overall state of the antique and decorative arts market just a few short years ago. For top auction house players like Sotheby's and Christie's, the numbers were impressive. Christie's tallied up $7.2 billion in auctions, and recorded another $1.2 billion in private sales, easily outperforming its sales figures of $7.1 billion it made in 2021. Of that total, just under a billion was derived from the sale of antiques and collectibles. "In 2022, despite a challenging macro-environment, Christie's has achieved our highest ever global sales," chief executive officer Guillaume Cerutti said, referring to post-pandemic economic challenges brought about by inflation and the global strife in eastern Europe. According to Christie's, buyers from North and South America accounted for the lion's share of total sales, with Asian buyers on the decline. However, what was most startling to some was the fact that the auction house said its banner year was fueled not by its trusted client-based list, but by a "new generation of collectors" - thirty-five percent who were first-time clients, and who also happened to qualify as millennials.  Sales Rise From Jewelry To Gas Signs Sales Rise From Jewelry To Gas Signs Pete Benning, an auction-watch analyst, who tracks more mainstream sales results for some of the larger auction houses, says that it's not just the big-players who are witnessing the entry into today's market by millennials. "It's everywhere," says Benning. "Younger collectors are really starting to take over the mantle left by boomers and are driving up prices across the board." According to Benning, aggregated sales results from almost all the major online auction sites (and smaller ones too), have shown steep increases in overall sales figures over the past year. "It's been a banner year for just about everyone," he said. Benning's research also indicated that while major art sales led the way to soaring profits, sales of high-end antiques and collectibles weren't far behind. Not to be outdone, Sotheby's also posted some chart-topping numbers with an estimated haul of just over $8 billion in combined art, land, and decorative art sales, with a substantial increase in tallies related to the sale of rare antique and vintage collector cars. While some of Sotheby's numbers were down in a few sectors, others rose, especially it's online auction sales of antiques and collectibles, which continued to post double-digit market gains. As with Christie's, the new younger collector has now also become a staple at Sotheby's, with most of its expanding client base over the last year coming from younger buyers in Asia. Bonham's auction house, though not as large as either Christie's or Sotheby's, took several steps this year towards changing that scenario through its acquisition of both New England-based Skinner and Copenhagen’s Bruun Rasmussen within a two-week period. The auction house buyouts are part of Bonham's broader strategy to expand its online presence and to re-connect to European markets after Brexit. Many who work within the company say the auction house has also seen strong sales results over the past twelve-months, especially in areas related to Chinese antiques, which is helping to propel its international growth strategy forward. However, it's not just larger global auction properties that are experiencing the jump in sales numbers, even smaller niche auction houses seem to be getting in on the record setting prices. Richmond Auctions out of Greenville, South Carolina, recently set a new world record this past September for the most expensive antique advertising sign sold at auction - a forty-eight inch double-sided porcelain Musgo Gasoline sign. The selling price of $1.5 million (including buyer's premium) shattered the previous record of $400,000, and proved to be the most profitable sale ever for the fledging auction house that had its first sale in 2020. Heritage Auctions out of Dallas, Texas, also hit new highs with its sale celebrating Abraham Lincoln’s 213th birthday. The two-day event drew a large crowd and brought in $4.3 million while setting a new world record for Americana sales at the auction house. For Pete Benning, results like this are simply further proof of just how far the antique and decorative arts markets have come over the past few years. Benning says that while online auction sales steadily up-ticked throughout Covids heyday, it wasn't until after the pandemic "officially" ended that the numbers for realized auction prices really started to escalate. "People were buying at online auctions during Covid, no question," says Benning, "but once everything dropped and we went back to normal, they exploded - not just at the larger auction houses - but on the smaller selling platforms too." Benning says he doesn't see much changing in the near future despite inflationary pressures and interest rate hikes, and says that if anything can curb the prodigious spending currently occurring at these auctions, he hasn't seen it yet. - AIA Staff Writers  NOTE: For readers seeking more information about the Asheford Institute Of Antiques distance-learning program on professional-level appraising, the study of antiques, collectibles, vintage and mid-century modern items, please click here to visit the school's Home Page. Should you have additional questions about the Asheford program, you can also write to the school at: info@asheford.com or call the Registrar's Office toll-free at: 1-877-444-4508.  A New Way Of Getting Business Done? A New Way Of Getting Business Done? New York - As today's digital warriors of the decorative arts update their monikers from being influential, to the more current influencer, it would seem that no descriptor with this amount of clout has undergone a more profound change in context and application over the last few years. Online platforms brim with those claiming to be 'influencers of style,' or having the capacity to effect 'the character, development, or behavior of specific trends.' But do they? Is this new generation of tech-savvy influencers actually transforming the antique and vintage market in a way that hasn't been seen before, or is this just the rehashing of an old familiar story? For many, the answer may simply lie in the uptick of numbers. As the recent worldwide pandemic revealed, people headed indoors for two years and started looking for something to do - including, creating new online profiles - with some estimating a thousand-fold increase in accounts related to the resale trade alone. For Instagram, this amounted to a whole new development of community based platforms predicated on interests like antiques and vintage goods. Major auction houses began to utilize Instagram 'stories' as a means of promotion through the creation of digital galleries. For other relative new-comers like TIk-Tok, the effects were even more pronounced, as hashtags like #antiques and #antiqustorefinds drew in over a hundred million views with dealers and collectors sharing video expertise of how to buy and sell. The Art Basel survey of "Global Collecting For 2022," also estimated that purchases of antiques and collectibles online accounted for over twenty-percent of total decorative arts sales - an increase of almost double since 2019. As online platforms grew, they also become more targeted in their approach with directed social media content and online viewing rooms becoming common selling tools that not only increased sales, but also brought in a new generation of young collectors to the market. While most dealers have welcomed the arrival of these new antique and vintage collectors, their initial reasoning for entering into the market in the first place appears to have been based on a somewhat altruistic desire to help support the artistic community; at least according to a 2022 Hiscox Online Trade Report, that found almost seventy-five percent of collectors under thirty-five wanted to assist artists and resellers who were part of the social upcycling and reuse movement. Eve Oliver, a top marketing representative for major antique fairs across the UK and Europe, says that young people simply want to buy furniture they won’t throw away tomorrow. "For nine out of ten younger customers that I’ve spoken to, the biggest drive is the environmental factor,” she says. Tom Holland, who's also a marketer, but who works with antique shows on this side of the pond, says that a number of older dealers have quietly acquiesced recently to the fact that using the latest Instagram presentation techniques and conducting business directly through DM's (Direct Messaging), has become a necessity, not an option. "If you want to attract the youthful buyers," says Holland, "you need to be playing their game with one click buys and offering creative ways of paying."  Presentation Can Make The Difference Presentation Can Make The Difference Former marketing analyst at Meta (Facebook/Instagram), John Chapman, who now runs his own decorative arts consulting and ad-placement firm for online entrepreneurs, says there's been a massive change in how people are conducting business today. Chapman says that during the pandemic he noticed younger profiles and accounts coming online that were specifically geared towards the antique and vintage industry. "It was something to do," he says, "they were locked in, but could buy and sell vintage and second-hand items while sitting behind their desk from home." This became transformational says Chapman, because as time progressed, these accounts became larger and more sophisticated in their appearance and in their approach to selling. Chapman says that before he left Meta for his own start-up, some of the biggest account growth he witnessed came from within the decorative arts community. "Some of these young vintage sellers really started to attract a following," he says, "I was literally stunned at how they had morphed from selling items on the kitchen counter, to complete professional grade photographic set-ups with tens-of-thousands of followers." In his current role, Chapman says he sees antique and vintage Insta-accounts all the time that have massive followings. "It's not just a few big names," says Chapman, "it's across-the-board interest by a huge number of people." Bridget Van Wart is a perfect example of what Chapman is talking about. In less than three years, her Halifax based vintage-themed Instagram account has gone from zero to over fifteen-thousand followers. "It's just blossomed into this community," says Van Wart. Using her own apartment as a backdrop, Van Wart has managed to refine the process of selling her vintage housewares by concentrating on presentation, and using her own décor to tastefully accentuate the items she's marketing. While she acknowledges that it's still "selling," Van Wart says that venues like Instagram provide her with the ability to be creative about the process. "The visual aspect of it is huge," says Van Wart. Other popular antique influencers such as the UK's, Jack Laver Brister (@tradchap), have also figured out that creative designs and helping people to envision those items within a home atmosphere are not just good for sales, but for brand exposure too. With over sixty-two thousand followers, Brister has become a prime influencer in one of the most competitive antique and decorative arts markets in the world. For many who do attain influencer status within the industry, it usually never comes about as a stand-alone effort. At least according to Tina Humphries, who's company specifically promotes growth-and-development strategies for accounts on sites like Instagram, Etsy and Tik-Tok. Humphries believes that popular success comes down to a lot of networking which helps spread the word. In her considerable experience, many of the younger players she's seen come to her with dreams of expanding their reach have already done a lot of the important work - namely - they've managed to get others to promote them by sharing. Humphries remembers one dealer in particular who came to her with a list of interior design influencers that supported her client by sharing the purchases they made with their followers. "Her growth was literally exponential," says Humphries, "in the end, there wasn't much for me to do since she'd already figured out that one of the biggest secrets to sustained online growth and influence was simply to get everyone else to act as an influencer for you." Humphries, who's company straddles the world of online promotion and the decorative arts, believes it's not really a question of whether or not these young upstarts are having any influence in the antique and vintage world, but more so a question of how much influence. "All I can do is look back at my own generation," she says with a smile, "when I was young, Martha Stewart was everywhere." - A.I.A. Staff Writers  NOTE: For readers seeking more information about the Asheford Institute Of Antiques distance-learning program on professional-level appraising, the study of antiques, collectibles, vintage and mid-century modern items, please click here to visit the school's Home Page. Should you have additional questions about the Asheford program, you can also write to the school at: info@asheford.com or call the Registrar's Office toll-free at: 1-877-444-4508. |

AIA StaffWe're providing our students and reader's with the latest breaking news on events and happenings that we think might be of interest to both collectors and dealers alike. Including changes within the world of antiques, vintage, collectibles and appraising that might just have an effect on your bottom line. We're also interested in hearing from you - so if you've got a great newsworthy story, let us know, and you just might find it here! Archives

July 2024

CategoriesLegal Disclaimer: Extraneous opinions, statements and comments made by individuals represented within these posts do not necessarily reflect those of the Institute. The publication naming of specific business entities, organizations, and concerns, contained herein, in no way represents an endorsement or recommendation of services or products by the Institute. Publicly identifiable information contained herein (including, but not limited to contact information), has been intentionally limited where possible, due to privacy and legal concerns related to the digital dissemination of information through online means. All views expressed herein are those of their respective owners. The Institute is in no way responsible, financially or otherwise, for the accuracy or validity of statements contained within published posts from sources that originate and appear outside of the written and expressed views of those submitted by the Institute.

|

RSS Feed

RSS Feed